Equal weight Exchange Traded Funds (ETFs) present a compelling strategy for investors targeting to construct a balanced portfolio that mitigates risk while promoting steady growth. Unlike traditional ETFs that allocate weights based on market capitalization, equal weight ETFs proportionally share assets among their underlying holdings, guaranteeing diversification across various sectors and industries. This approach can aid investors capture broader market exposure and potentially minimize the impact of individual stock volatility on overall portfolio performance.

- Additionally, equal weight ETFs often exhibit lower correlation with traditional market benchmarks, providing a potential hedge against market downturns.

- Consequently, investors may derive advantage from utilizing equal weight ETFs as a component of a well-diversified portfolio strategy aimed at achieving long-term growth objectives.

Equal Weight vs. Market Cap ETFs: Diversifying Your Investment

When crafting a robust investment strategy, diversification is key to mitigating risk and enhancing potential returns. Two popular approaches within the realm of Exchange-Traded Funds (ETFs) are equal weight and market cap weighting. Equal weight ETFs assign an equal value to each holding within the index, regardless of its market capitalization. Conversely, market cap weighted ETFs proportionally allocate assets based on a company's market value. While both offer exposure to diverse sectors and asset classes, they present distinct characteristics.

- Equal weight ETFs can provide broader diversification by ensuring each holding carries equal weight, potentially reducing the impact of a single company's performance on the overall fund.

- Market cap weighted ETFs tend to mirror the broader market more closely, as they concentrate investments in larger companies that often exhibit greater stability and growth potential.

Ultimately, the best choice depends on your financial objectives. Assess your individual circumstances and explore both equal weight and market cap weighted ETFs before making an informed selection.

Mastering Equal Weight ETFs for Consistent Returns

Achieving consistent returns in the dynamic realm can be a daunt. However, investors looking for a strategic approach may find advantage in equal weight ETFs. These funds distribute assets equally across components, mitigating the volatility associated with top-heavy portfolios. By spreading investment more proportionally, equal weight ETFs can promote stability and potentially boost long-term growth.

- Fundamental analysis remains essential when selecting equal weight ETFs.

- Researching the underlying composites and their sectors can provide valuable understanding.

- It's also essential to observe the results of ETFs over time, making tweaks as needed.

Equal Weight ETFs: A Strong Choice for Shifting Markets

In dynamic markets, traditional cap-weighted ETFs can become skewed. This is where equal weight ETFs stand out, offering a unique approach by assigning capital equally across every holding.

As market shifts evolve rapidly, equal weight ETFs offer the opportunity of minimizing risk by distributing exposure evenly. This can result in a more consistent portfolio journey, particularly during periods of volatility.

Moreover, equal weight ETFs often reflect the performance of specific industries more faithfully, as they minimize the influence of large-cap giants that can sometimes dominate traditional indexes.

This approach makes equal weight ETFs a compelling consideration for investors seeking to navigate shifting landscapes of today's markets.

Must You Select Equal Weight or Market Cap-Weighted ETFs?{

When diversifying in the market, you'll frequently run into Exchange Traded Funds (ETFs). Two popular types of ETFs are Equal Weight and Market Cap-Weighted. Each method delivers a distinct way to mirror the market, and choosing the right one depends on your investment goals and threshold for risk.

Equal Weight ETFs distribute investments proportionately across holdings. This means each company carries the same importance in the portfolio, regardless of its market capitalization. Conversely, Market Cap-Weighted ETFs mirror the market by assigning assets determined by their market value. Larger companies therefore have a larger impact on the ETF's performance.

Grasping the differences between these two approaches is essential for making an intelligent decision that fulfills your investment objectives.

Crafting a Resilient Portfolio with Equal Weight ETFs

A resilient portfolio can withstand the shocks of the market. One method to attain this is through employing equal weight ETFs. These funds assign their assets proportionally across check here holdings, minimizing the impact of single company's movements. This strategy can lead to broadening and potentially smooth returns over the long term.

- Assess equal weight ETFs if you seek a well-distributed portfolio.

- Research various sectors and investment types to find ETFs that align your risk tolerance.

- Bear in thought that past performance are not promised future outcomes.

Danny Tamberelli Then & Now!

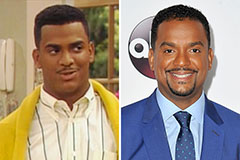

Danny Tamberelli Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!